Ninety per cent of Canadians expect financial impact from major illnesses but remain frozen when it comes to preventive measures

Nov 16, 2011

Sun Life Canadian Health Index™ reveals majority of Canadians aren't prepared for future health costs

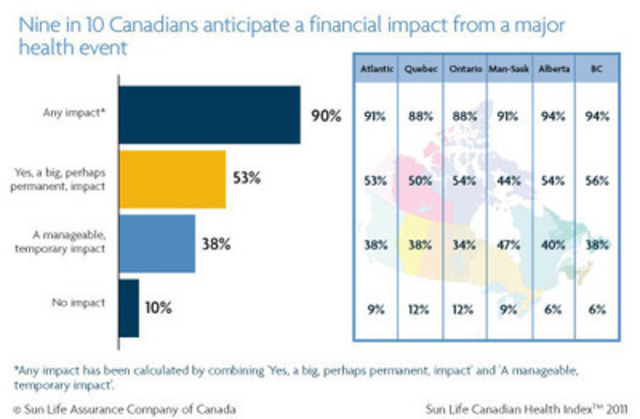

TORONTO, Nov. 16, 2011 /CNW/ - How financially prepared are you for a serious illness? Nine out of 10 Canadians anticipate a financial impact if they were to experience a major or chronic illness, with more than half (53 per cent) saying that impact would be significant or perhaps permanent, according to the second annual Sun Life Canadian Health Index™ compiled by Ipsos Reid.

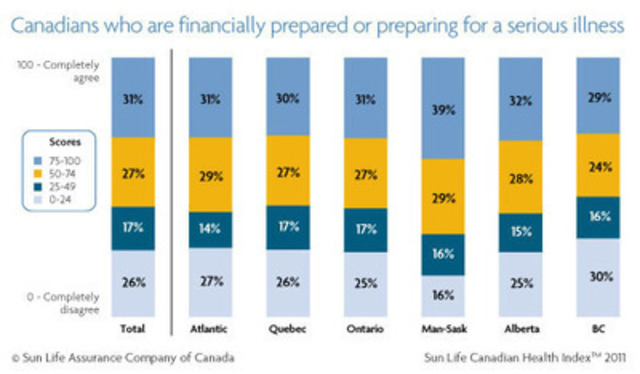

Despite these high awareness levels, only 58 per cent of Canadians are either preparing, or are currently prepared financially in case they get sick. And only eight per cent of Canadians have a written financial plan that includes insurance and risk management - two elements that address the economic impact that could come with a major health issue.

"Canadians' understanding of the connections between health and personal finances are hard-earned," said Kevin Strain, Senior Vice-President, Individual Insurance and Investments, Sun Life Financial Canada. "We found the majority of Canadians have either personally experienced or have had someone close to them suffer a serious health issue. However, fewer than one in five said they had evaluated or re-visited their finances following the experience."

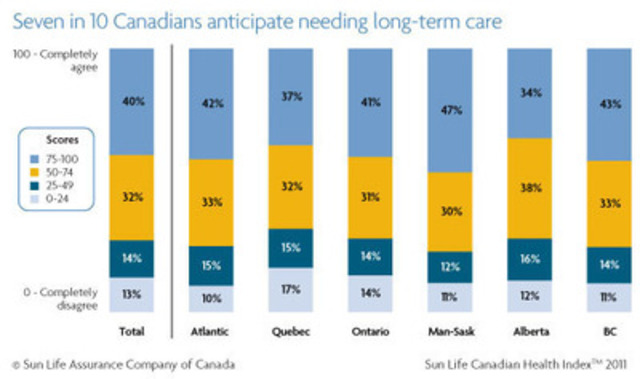

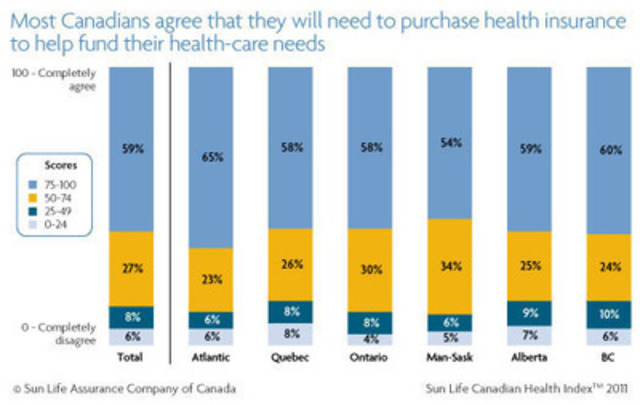

Overall, many Canadians expect a long life. The average respondent anticipates living 81.5 years, almost a year more than the Statistics Canada reported average of 80.7 years1. Eighty-six per cent of Canadians agree that they will need to purchase health insurance to help fund their health care needs, as the public system will not be able to maintain current funding levels as the population ages and costs rise. Seven out of 10 respondents (72 per cent) think they will probably need some form of long-term care as they age.

"We want Canadians to feel empowered about their finances, especially when it comes to planning for long-term care or the financial impact of a major illness," said Strain. "The last thing anyone wants to worry about is money when making important decisions about their health. Working with an advisor to create a financial plan that includes protection will ease the tension during an already stressful time."

Tips for Canadians to take control of their finances:

- Meet with a trusted advisor or financial planner to discuss your needs and goals.

- Create a long-term financial plan covering investing and protection of assets as well as retirement planning.

- Review the plan regularly and make adjustments based on changes to your life and health situation.

For additional practical tips on ways to take control of your health and finances, visit www.brighterlife.ca.

Measuring Canadians' attitudes, perceptions and behaviours about their health

The 2011 Sun Life Canadian Health Index™ measures the attitudes, perceptions and behaviours of Canadians relating to their personal health. This second wave in a series of studies yielded an overall index score of 68.1 on a scale of 0 to 100. A person who scored high on the overall Sun Life Canadian Health Index™ also scored high on each of the individual attitudinal, behavioural and perceived health components. The overall index is a blend of scores in three sub-indices: Perceived Health Index (score = 71.2), Attitudinal Health Index (score = 65.7) and Behavioural Health Index (score = 67.5). For more information about the study, visit www.sunlife.ca/CanadianHealthIndex.

Methodology

These are some of the findings of an Ipsos Reid poll conducted between July 27 and September 12, 2011 on behalf of Sun Life Financial. For this survey, a sample of 3,233 Canadians aged 18 to 80 years old from Ipsos' Canadian online panel was interviewed online. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. A survey with an unweighted probability sample of this size and a 100 per cent response rate would have an estimated margin of error of +/- 2 percentage points, 19 times out of 20, of what the results would have been had the entire population of adults in Canada been polled. The margin of error will be larger within regions and for other sub-groupings of the survey population. The Sun Life Canadian Health Index™ is composed of a series of sub-indices composed of attitudinal, behavioural and perceived measures, each benchmarked to 100. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

About Sun Life Financial

Sun Life Financial is a leading international financial services organization providing a diverse range of protection and wealth accumulation products and services to individuals and corporate customers. Chartered in 1865, Sun Life Financial and its partners today have operations in key markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China and Bermuda. As of September 30, 2011, the Sun Life Financial group of companies had total assets under management of $459 billion. For more information please visit www.sunlife.com.

Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

Note to Editors: All figures in Canadian dollars.

_____________________________

1 Statistics Canada: Deaths, 2007 http://www.statcan.gc.ca/daily-quotidien/100223/dq100223a-eng.htm

Image with caption: "Nine out of 10 Canadians anticipate a financial impact if they were to experience a major or chronic illness. (CNW Group/Sun Life Financial Inc.)". Image available at: http://photos.newswire.ca/images/download/20111116_C6197_PHOTO_EN_6723.jpg

Image with caption: "Only 58 per cent of Canadians are either preparing, or are currently prepared financially in case they get sick. (CNW Group/Sun Life Financial Inc.)". Image available at: http://photos.newswire.ca/images/download/20111116_C6197_PHOTO_EN_6724.jpg

Image with caption: "Many Canadians anticipate needing long-term care as they age. (CNW Group/Sun Life Financial Inc.)". Image available at: http://photos.newswire.ca/images/download/20111116_C6197_PHOTO_EN_6720.jpg

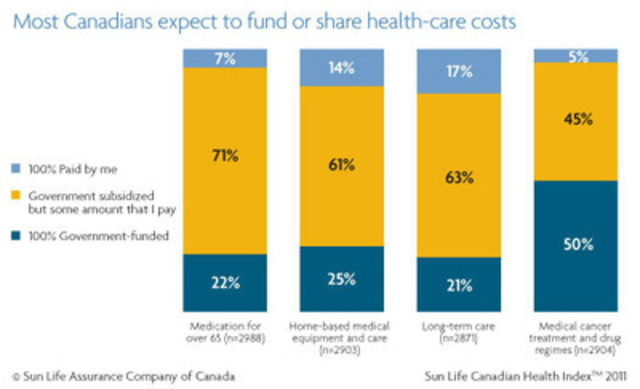

Image with caption: "Almost one in five adults expects to pay the entire cost of long-term care themselves with no government subsidies (17 per cent), while 21 per cent expect government to pay the entire cost and 63 per cent expect government subsidies. When it comes to illnesses like cancer, half of Canadians think they will have to share some of the cost of medical treatments and drug regimes. (CNW Group/Sun Life Financial Inc.)". Image available at: http://photos.newswire.ca/images/download/20111116_C6197_PHOTO_EN_6721.jpg

Image with caption: "Eighty-six per cent of Canadians agree they will need to purchase health insurance to help fund their healthcare needs as the public system will not be able to maintain current funding levels as the population ages and costs rise. (CNW Group/Sun Life Financial Inc.)". Image available at: http://photos.newswire.ca/images/download/20111116_C6197_PHOTO_EN_6722.jpg

For further information:

Media Relations contact:

Nadine Ricketts

Media & Public Relations

Sun Life Financial

Tel: 416-979-6273

nadine.ricketts@sunlife.com