The not so golden years - 1 in 4 Canadian retirees living with debt

Feb 21, 2018

Baby boomers burdened by mortgage and unpaid credit

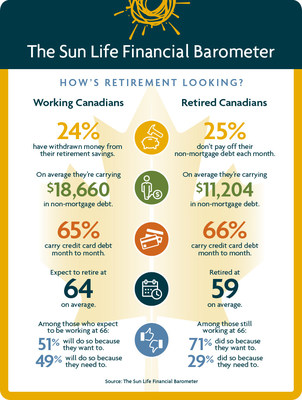

TORONTO, Feb. 21, 2018 /CNW/ - A worry-free retirement may be a thing of the past as Canadians struggle to manage debt. From living with a mortgage to unpaid credit cards, retirees can find themselves facing financial challenges in their golden years.The Sun Life Financial Barometer, a new national survey, found that one-in-four (25%) retirees are facing such challenges and living with debt.

Baby boomers are no stranger to today's increased financial demand; in fact, one-in-five (20%) retirees are still making mortgage payments. The financial strain doesn't stop there, the survey results reveal that retirees still use credit in some of the same ways they did before retirement. Mortgage aside, here's where they still owe money:

- 66% have unpaid credit cards;

- 26% are making car payments;

- 7% have unpaid health expenses;

- 7% owe money on holiday expenses or vacation property; and

- 6% haven't paid off home renovations.

"Through our national survey, we took a moment to check-in with Canadians and gauge how they are stacking up when it comes to their finances," said Jacques Goulet, President, Sun Life Financial Canada. "From credit card debt to a mortgage, retirees are faced with a list of expenses in life after work. We recognize that managing finances can be overwhelming, particularly for those who are no longer working. Seeking sound advice and working with a financial advisor can help you reach your goals."

At the same time retirees face lingering debt, almost one-quarter (24%) of working Canadians are dipping into their retirement savings. Canadians pulled cash for the following reasons:

- 63% did so because they needed to (e.g., health expenses, debt repayment);

- 24% as part of the First Time Home Buyers' Plan; and

- 13% because they wanted to (e.g., vacation, car purchase).

"Our survey results highlight the importance of getting ready for retirement," explains Tom Reid, Senior Vice-President, Group Retirement Services, Sun Life Financial Canada. "Although it can seem far away, retirement creeps up faster than you think – building a financial plan and making meaningful contributions will pay off in the long run. There are helpful tools and resources you can tap into to get on the right track to building the income you want and need to retire."

The following tips can help Canadians save for a bright retirement:

- Start now. Begin saving and investing as early as possible to set yourself up for success.

- Don't leave money on the table. If your employer offers a pension plan and will match your contributions, contribute the maximum amount possible.

- Invest wisely. If you do not have access to a defined contribution plan, RRSPs and TFSAs are other great vehicles to consider.

- Have a plan and stick to it. It's never too late to build a financial plan that will get you where you want to be.

- Seek valuable advice. A financial advisor can help you create a financial plan, set achievable goals, and guide you through each life stage.

Ready to get started? Find a Sun Life Financial advisor who can support you on your journey to achieve a lifetime of financial security and well-being.

Sun Life Assurance Company of Canada is a member of the Sun Life Financial group of companies.

About the survey

The Sun Life Financial Barometer is based on findings of an Ipsos poll conducted between October 13 and October 19, 2017. A sample of 2,900 Canadians was drawn from the Ipsos I-Say online panel: 2,900 Canadians from 20 to 80 years of age. The data for Canadians surveyed was weighted to ensure the sample's regional, age, and gender composition reflects that of the actual Canadian population.

The precision of Ipsos online poll is measured using a credibility interval. In this case, the poll is accurate to within +/- 2.1% at 95% confidence level had all Canadian adults been polled. All sample surveys and polls may be subject to other sources of error, including, but not limited to methodological change, coverage error and measurement error.

About Sun Life Financial

Sun Life Financial is a leading international financial services organization providing insurance, wealth and asset management solutions to individual and corporate Clients. Sun Life Financial has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of December 31, 2017, Sun Life Financial had total assets under management ("AUM") of $975 billion. For more information please visit www.sunlife.com.

Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.

Note to Editors: All figures in Canadian dollars except as otherwise noted.

Media Relations Contact:

Kim Armstrong

Manager, Media & PR

Corporate Communications

T. 416-979-6207

kim.armstrong@sunlife.com

SOURCE Sun Life Financial Canada